Household Employment Blog

Understanding What it Means to be a Household Employer

New Form I-9 is now Mandatory for Employers to Use

The new Form I-9—the form used to verify the identity and employment authorization of all individuals hired for employment in the United States – was released on November 14, 2016. Here are some of the most common Form I-9 FAQs we’ve received.

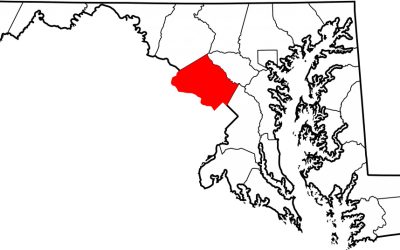

Montgomery County Sick Leave/Safe Time

The Montgomery County Sick Leave law requires employers with one or more employees in the Maryland county to provide paid sick and safe leave to covered employees, including domestic workers.

13 Steps to Hassle-Free 2017 Nanny Taxes

This is the time of year when many household employers are scrambling to pull together 12 months' worth of pay and tax information so they can issue their employee a W-2, submit Form W-3 to the Social Security Administration, and begin preparing Schedule H to file...

Help for Intuit Household Payroll Customers

Inuit has discontinued its household payroll product for domestic employers. While you’ll be able to complete your 2016 tax return (through April 20, 2017), Intuit Household Payroll customers will not be able to process payroll for 2017 pay dates. A complete solution...

Trump’s Plan to Cut Childcare Costs Moves Forward

As Inauguration Day draws near, we’re getting a clearer picture of President-elect Donald Trump’s priorities when he takes office. Reducing childcare costs was a centerpiece of Trump’s proposed tax plan during the campaign. It remains a focal point as he seeks...

Not Paying Nanny Taxes Could Derail Your Career Opportunity

You’ve worked hard. You’ve sacrificed. Your professional resume is impeccable. You’ve cleared the background checks. You’re cruising through the vetting process for your new, high-level job. Then come the questions that make your palms sweat, create a lump in your throat and knock you off stride.

2016 Year End Tax Planning for Households

The end of 2016 is only about 2 weeks away, so it’s important that everything is in order to ensure there are no surprises when it comes time to pay your nanny taxes next year. We recommend not putting off or ignoring your 2016 year end tax planning.

Illinois Victims’ Economic Security and Safety Act

The Illinois Victims’ Economic Security and Safety Act (VESSA) allows employees to take unpaid leave to handle domestic or sexual violence issues. A new amendment to this law applies to household employers.

Trump Tax Plan: What it Means for Domestic Employers

Now that President-elect Trump will take residence in the White House a few short weeks from now, let’s take a closer look at the Trump tax plan and how it impacts families that have child care. Trump’s proposal to help reduce the costs of child care could also impact...

Sign up for our Newsletter

Household Employer Digest

Get your free:

Get your free: