Household Employment Blog

Understanding What it Means to be a Household Employer

7 Steps to Protect Yourself as a Household Employer

As a family that has hired someone to work in their home – like a nanny, senior caregiver, or housekeeper – you are now considered a household employer and should understand and follow applicable labor laws. Here are seven steps to protect yourself from allegations of wrongful employment practices.

What are the Benefits of Legally Paying Your Nanny?

The benefits of legally paying your nanny ensures fairness and protects both parties. It’s a win-win situation for both you and your nanny. You’ll gain peace of mind, reduce legal risks, and potentially qualify for tax breaks. Your nanny will benefit from financial security, social security contributions, and a professional working relationship.

How to Hire a Summer Nanny

Summer may be the time of year to sit back, relax and recharge. Unless of course, you have kids. When school begins again, you could be exhausted. Where did the summer go? And what happened to relaxation? This is where a summer nanny can make your life easier and the season more fun for your kids.

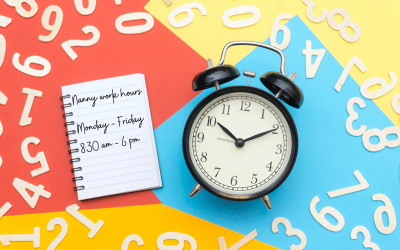

What are Guaranteed Hours for a Nanny?

Guaranteed hours for a nanny, an industry standard in household employment, are the set number of hours your caregiver will be paid each week. Here’s how guaranteed hours work and why they benefit not only your nanny but your family as well.

Nanny Wants to Be Paid Under the Table?

The awesome nanny you plan to hire wants to be paid off the books. You know the risks but do you take a chance and go along with your nanny? Nannies, however, often don’t see the bigger picture when it comes to being paid legally and what benefits (both immediate and long-term) they may be missing. Here’s what to say to get them on board with legal pay.

How to Calculate Your Nanny Taxes

Calculating nanny taxes is an important step when hiring an in-home caregiver for your children. It’ll help you understand your total budget for childcare beyond just the wages you’ll pay your nanny. Here’s what you need to know.

Can I Pay my Nanny Through my Business Payroll?

If you run a business and employ household help, can you pay that employee through your company payroll? This is a common tax question that can affect your personal and company finances. The short answer is no – a household employee shouldn’t be paid by a corporate entity through their business payroll. Here’s why.

How to Offer a Retirement Plan to a Household Employee

Families with household help may consider offering a retirement plan to their employees to help attract top candidates to their jobs and retain their best employees. It’s easy to do and GTM can help.

Labor Dept. Revises Rules on Classifying Independent Contractors: What This Means for Household Employers

The U.S. DOL recently released a final rule designed to reduce the risk of employees being misclassified as independent contractors, which can be an issue for families with household help. Here’s what this all means for household employers.

Sign up for our Newsletter

Household Employer Digest

Get your free:

Get your free: