The benefits of legally paying your nanny ensures fairness and protects both parties. It’s a win-win situation for both you and your nanny. You’ll gain peace of mind, reduce legal risks, and potentially qualify for tax breaks. Your nanny will benefit from financial security, social security contributions, and a professional working relationship.

Blog Category:

Hiring an Employee

How to Hire a Summer Nanny

Summer may be the time of year to sit back, relax and recharge. Unless of course, you have kids. When school begins again, you could be exhausted. Where did the summer go? And what happened to relaxation? This is where a summer nanny can make your life easier and the season more fun for your kids.

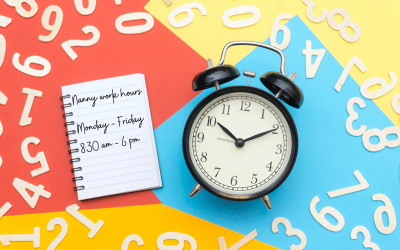

What are Guaranteed Hours for a Nanny?

Guaranteed hours for a nanny, an industry standard in household employment, are the set number of hours your caregiver will be paid each week. Here’s how guaranteed hours work and why they benefit not only your nanny but your family as well.

Nanny Wants to Be Paid Under the Table?

The awesome nanny you plan to hire wants to be paid off the books. You know the risks but do you take a chance and go along with your nanny? Nannies, however, often don’t see the bigger picture when it comes to being paid legally and what benefits (both immediate and long-term) they may be missing. Here’s what to say to get them on board with legal pay.

How to Calculate Your Nanny Taxes

Calculating nanny taxes is an important step when hiring an in-home caregiver for your children. It’ll help you understand your total budget for childcare beyond just the wages you’ll pay your nanny. Here’s what you need to know.

How to Offer a Retirement Plan to a Household Employee

Families with household help may consider offering a retirement plan to their employees to help attract top candidates to their jobs and retain their best employees. It’s easy to do and GTM can help.

Labor Dept. Revises Rules on Classifying Independent Contractors: What This Means for Household Employers

The U.S. DOL recently released a final rule designed to reduce the risk of employees being misclassified as independent contractors, which can be an issue for families with household help. Here’s what this all means for household employers.

Washington, D.C. Pay Transparency: What Household Employers Need to Know

Under Washington, D.C.’s pay transparency law, household employers will need to provide pay ranges for job postings and inform job applicants of healthcare benefits, while prohibiting employers from seeking information on salary history.

10 Nanny Tax Forms Every Household Employer Needs to Know About

Being a household employer comes with a fair share of paperwork. Getting set up as an employer, withholding and remitting nanny taxes, and taking care of year-end taxes all require forms to be filled out by you and/or your nanny. Here are the 10 nanny tax forms every household employer will need.

Sign up for our Newsletter

Household Employer Digest

Get your free:

Get your free: