If a household worker, such as a nanny or housekeeper, earns $2,100 or more in cash wages in 2018, Social Security and Medicare taxes, commonly referred to as “nanny taxes,” must be paid by the family and the employee.

Blog Category:

Household Payroll & Taxes

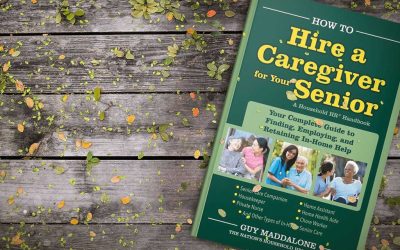

New Book Provides Guidance to Families Hiring Senior Care

This comprehensive guide provides critical guidance to the millions of families that care for a senior parent, relative or friend. However, many of these families also care for their own children while juggling careers and other responsibilities.

Infographic: Nanny Tax Compliance

Mistakes or misinterpretations of nanny tax compliance laws can mean IRS audits, thousands of dollars in fines and penalties or an employee lawsuit. Our handy infographic highlights what you need to do to maintain nanny tax compliance.

The Growing Demand for Senior Care

By 2020, 54 million people in the U.S. will be over the age of 65; by 2040, that number will top 82 million. We can see the growing demand for senior care is critical in our lives and so it will continue.

How to Hire a Nanny Provides Practical Guidance to Families on Finding Household Help

The latest edition of How to Hire a Nanny: Your Complete Guide to Finding, Hiring, and Retaining Household Help is now available to purchase as a paperback or Kindle download on Amazon. The third edition of the book has been updated for 2017 to reflect new Domestic...

Understanding Nanny Taxes and What to Pay

Part of the responsibilites of being a household employer is understanding nanny taxes – what they are and what to pay. Use this helpful guide to assist you in complying with nanny tax laws.

New Rules for Paying Home Healthcare Employees

New York’s new rules for paying home healthcare employees now requires that those employees be paid for all hours in a client’s home in a 24-hour period, including sleep and meal periods.

Planning for Summer Household Employment

Families often ask for advice on handling different issues that arise when planning for summertime household employment, so let’s take a look at some of the most common concerns.

13 Steps to Hassle-Free 2017 Nanny Taxes

This is the time of year when many household employers are scrambling to pull together 12 months' worth of pay and tax information so they can issue their employee a W-2, submit Form W-3 to the Social Security Administration, and begin preparing Schedule H to file...

Sign up for our Newsletter

Household Employer Digest

Get your free:

Get your free: