Under the new Oregon sick leave law beginning January 1, 2016, Oregon employers will be required to provide up to 40 hours of sick time each year, depending on how many hours an employee works. Who Is Covered? The law applies to most employees—exempt, non-exempt,...

Blog Category:

Tax & Wage Laws

2016 Standard Mileage Rate Announced

The 2016 standard mileage rate has been announced by the IRS. This rate is used to calculate the deductible costs of driving a vehicle for business. This applies to household employers who choose to let their nanny or other household employee use their car for...

2015 Year End Tax Planning for Households

The end of 2015 is only about 2 weeks away, so it’s important that everything is in order to ensure there are no surprises when it comes time to pay your nanny taxes next year. We recommend not putting off or ignoring your 2015 year end tax planning. It’s important to...

2016 Minimum Wage Changes

Under the Fair Labor Standards Act (FLSA), employers – including household employers – in all states must pay their employees at least the state's minimum wage. This wage rate often changes at the beginning of a new year, so it's important for families with domestic...

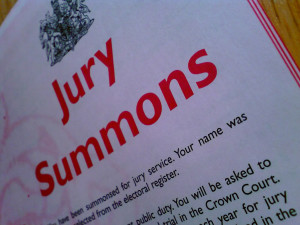

Time Off for Civic Duties

Household employers should be aware and well-informed of the more often-used leave laws like sick leave or Family Medical Leave, but other leave laws will arise. Employers are typically mandated to provide time off for civic duties like voting, witness leave, and jury...

Benefits of Being Paid “On the Books”

Nannies and other household employees hold jobs like any other professional and should be paid legally to gain important protections and advantages. You will need to pay taxes but the benefits will far outweigh the small amount taken out of your paycheck. Here are...

Nanny Tax Threshold for 2016

The Social Security Administration (SSA) announced yesterday that the nanny tax threshold for 2016 will increase to $2,000, up from $1,900 this year. This affects all employers of domestic workers - if you pay your employee at least $2,000 in 2016, you are required to...

Interviewing a Nanny: Asking About Disabilities

Q: We will be interviewing a nanny who came highly recommended. But we have heard from a friend that this nanny has been in and out of the hospital lately due to back pain. Is this something we can ask her about during the interview? A: According to the Americans...

4 Key Reasons to Use a Nanny Payroll Service

There is more to paying your household employee than just cutting them a paycheck each week. Taxes need to be paid (by the employer and employee) and insurance coverage may need to be in place, just to start. The four key reasons to use a nanny payroll service are: 1....

Sign up for our Newsletter

Household Employer Digest

Get your free:

Get your free: