Nanny Tax Calculator for

Household Employers

Understand your nanny tax and payroll obligations with our nanny tax calculator

Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer, whether paying a nanny, a senior care worker, or other household employees.*

Or if you need more help talking it through, get a free phone consultation with one of our household experts: 800-929-9213.

Estimate Tax Withholdings

Enter wage amount, pay frequency, withholding status and allowances, and we’ll calculate your withholdings and employer responsibilities.

Estimate Tax Savings

Figure out your estimated annual tax savings for employer-offered Flexible Savings Accounts (FSAs) or Dependent Care Assistance Plan (DCAPs)

Convert Gross and Net Pay

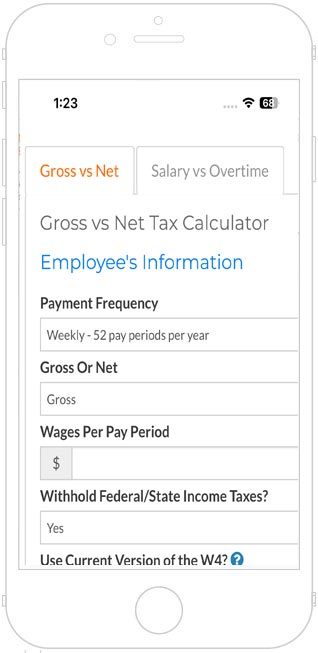

Easily calculate the take-home (Net) pay to the employee from a total (Gross) amount, and vice versa.

Convert Salary to Hourly Rates of Pay

Enter weekly hours and salary and calculate the standard rate of pay and overtime rate of pay per hour.

Use the Nanny Tax Calculator to:

- Estimate Tax Withholdings

- Convert Gross to Net Pay (and vice-versa)

- Convert Salary to Hourly Rates of Pay

- Estimate Tax Savings for employer-offered Flexible Savings Accounts or Dependent Care Assistance Plans

Related Video: Gross Pay vs Net Pay

Knowing the difference between gross and net pay is important when negotiating a salary for your household employee. Learn why in this brief video.

Questions? Get Help with Household Payroll

A household payroll expert can answer questions you have about your own situation.

Call or chat with us during business hours, or schedule a free consultation at your convenience.

Call Toll Free: 800-929-9213

Hours: Mon-Fri 8:30 am - 8pm, ET

Get your free:

Get your free: