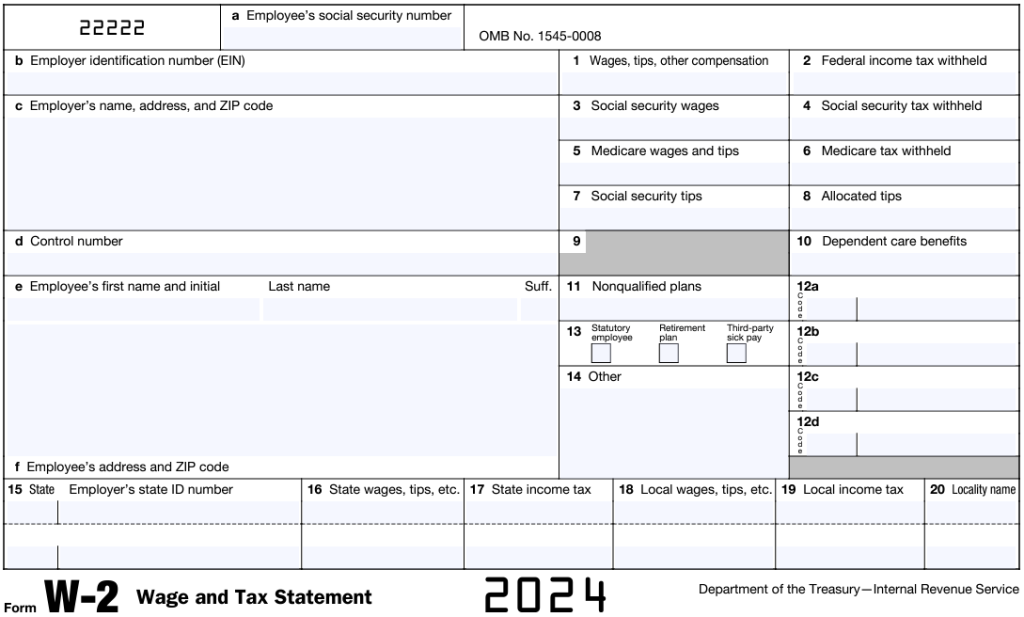

Form W-2 is a tax form that reports wages paid to an employee and the taxes withheld from their pay.

Form W-2

Your employer will provide you with Form W-2 in January, which shows how much money you earned and taxes withheld from your paychecks as well as benefits provided during the previous year.

Information from Form W-2 is used when you file your personal tax returns – both federal and state (if applicable) – with the IRS and your state’s tax agency.

You will receive three copies of Form W-2:

- Copy B is filed with your federal tax return

- Copy 2 is used to report any state, city, or local income taxes

- Copy C is for your records. Keep a W-2 for at least three years after you file or the due date of your return, whichever is later

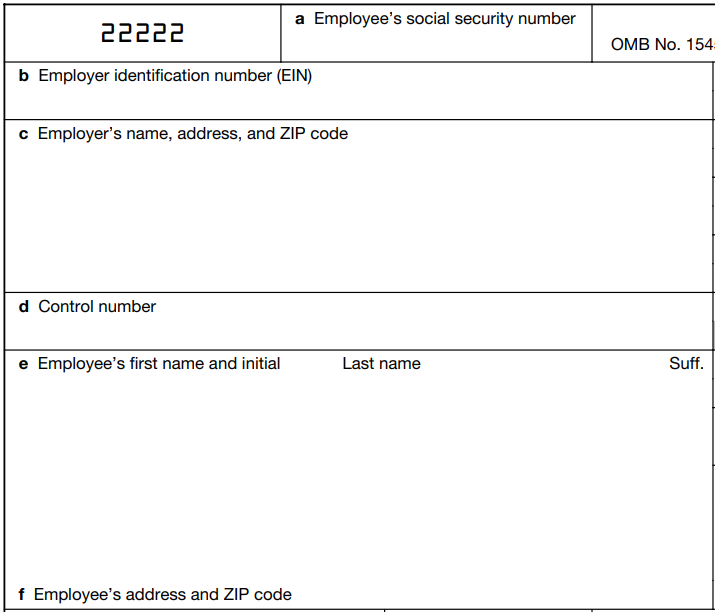

The left side of Form W-2 shows taxpayer information.

Your taxpayer information appears on the left side of Form W-2

Box a: Your Social Security Number (SSN). Always double-check to make sure this is correct. If not, tell your employer and get a new, corrected Form W-2 (called Form W-2c).

Box b: Your employer’s EIN. This is like your employer’s SSN for reporting taxes.

Box c: Your employer’s address. For household employees, this is likely your employer’s home address.

Box d: A control number is an internal number that can be used by an employer. Do not worry if box d is blank. It simply means your employer does not use control numbers.

Box e & Box f: Your name and address. Your name should reflect what is on your SSN. If they do not match, you will need a new Form W-2. Your address should be your mailing address. Inform your employer if you have a new address so they can update their records.

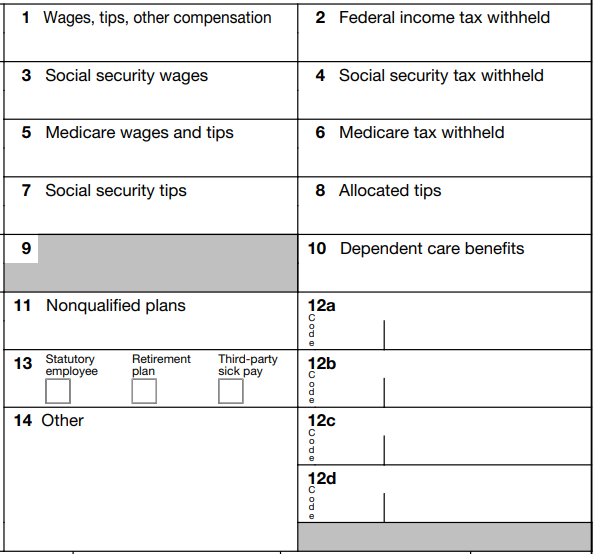

The right side of Form W-2 reports wages, taxes withheld, and benefits.

The right side of Form W-2 reports wages, taxes withheld, and benefits.

Box 1: Taxable wages, tips, and other compensation. This does not include any retirement plan contributions, pretax benefits, or payroll deductions. Taxable fringe benefits are included in Box 1. It is not uncommon for the amount in Box 1 to be less than boxes 3 and 5.

Box 2: Federal income tax withheld. This amount is determined by how you completed Form W-4. If you had too much or too little taken out of your pay, you can submit a new Form W-4. Keep in mind that it is optional (but recommended) for household employers to withhold federal income tax from their employee’s pay.

Box 3: Social security wages. This is your total wages subject to the Social Security tax.

Box 4: Social security tax withheld. This is the amount withheld from your pay (6.2% of wages) for Social Security taxes.

Box 5: Medicare wages and tips. This is your total wages subject to Medicare taxes.

Box 6: Medicare tax withheld. This is the amount withheld from your pay (1.45% of wages) for Medicare taxes. Unlike income taxes, Social Security and Medicare taxes are required to be withheld from a household employee’s pay.

Boxes 7 & 8: Social security tips & Allocated tips. Since it is highly unlikely that tips were reported to your employer (box 7) or allocated to you by your employer (box 8), these will be blank on your Form W-2.

Box 9: Verification code. If your Form W-2 contains a 16-digit verification code, you should enter this number when using software to electronically file your return. It is used to verify that the form is authentic. If there is no code in this box, your tax return will still be accepted.

Box 10: Dependent care benefits. If you received any paid benefits through your employer’s dependent care assistance program, that will be reported here.

Box 11: Non-qualified plans. This is used to report money distributed to you from your employer’s non-qualified deferred compensation plan. This box will likely be blank for household employees.

Box 12: Codes. These boxes report a variety of other income sources – although not all of them are taxable. Some codes and amounts you may see here include D (contributions to your employer’s 401k retirement plan); P (moving expenses paid directly to you); W (employer contributions to a health savings account); DD (cost of employer-sponsored health coverage); and FF (benefits received through a QSEHRA).

Box 13: Statutory employee, retirement plan, third-party sick pay. Household workers are not statutory employees. However, you may have received sick pay through your state’s disability insurance program or had retirement plan contributions if you participated in one during the year.

Box 14: Other. This will include anything that does not fit in any other box. This could include state disability insurance taxes withheld, health insurance premiums deducted, and non-taxable income. If you do not understand the amount in this box, ask your employer.

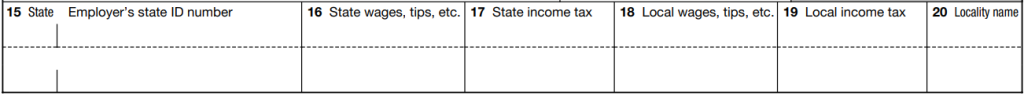

The bottom of Form W-2 is for state and local tax reporting.

The bottom of Form W-2 is for state and local tax reporting.

Box 15: State and Employer’s state ID number. This will show your employer’s state and state tax ID number. If you live in a state without an income tax, this box will be blank. If you worked for your employer in multiple states during the year (for example, you worked at their summer home in a different state), then those states will also be displayed.

Box 16: State, wages, tips, etc. This is your wage amount subject to state income taxes (if applicable).

Box 17: State income tax. If you have wages reported in box 16, the tax withheld on that income is reported here.

Box 18: Local wages, tips, etc. If you are subject to local or city taxes, those wages will be shown here.

Box 19: Local income tax. Local taxes withheld will be displayed here if you have wages reported in box 18.

Box 20: Locality name. This is the name of the city or locality where your wages were subject to local taxes.

Tax Tips

- Use GTM’s nanny tax calculator to estimate your total withholdings and tax responsibility, determine your take-home (or net pay), and convert a salary to an hourly rate of pay.

- When completing Form W-4, consider using the IRS tax withholding estimator if you:

- Expect to work only part of the year;

- Have dividend or capital gain income, or are subject to additional taxes, such as Additional Medicare Tax

- Have self-employment income; or

- Prefer the most accurate withholding for multiple job situations

GTM Can Help

For employees paid through GTM Payroll Services, our client support team can help answer questions you may have about Form W-2. Just call us at (800) 929-9213 or email [email protected].

Get your free:

Get your free: