Form W-4 helps you determine how much federal income tax should be withheld from your paycheck each pay period. Withholding income tax from a household employee’s pay is not required, but highly recommended. If income taxes are not taken out each pay period, then you will owe your entire tax obligation when you file your personal tax return. If your employer agrees to withhold income tax, they will provide you with Form W-4.

Here’s how to complete this form so the right amount of tax is withheld from your pay.

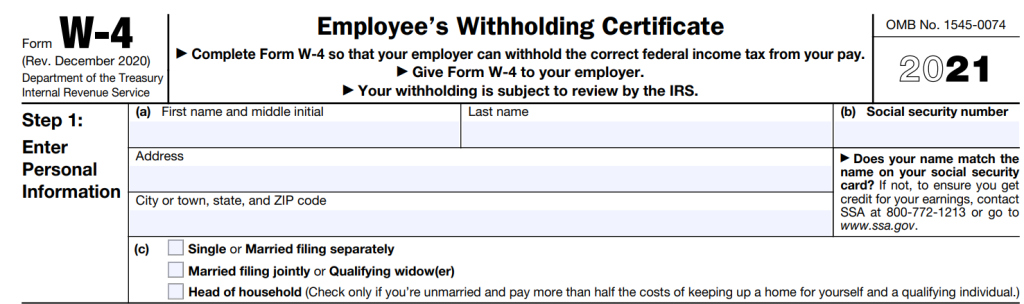

Step 1: Enter your personal info: name, address, Social Security number, and filing status.

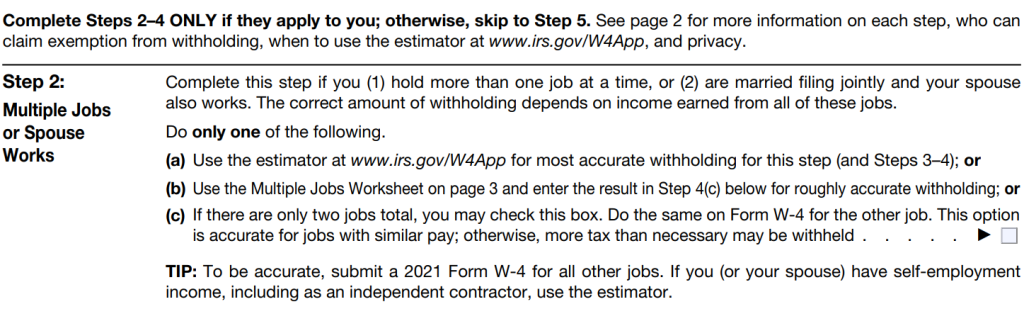

Step 2: Only go to Step 2 if you have more than one job or you file jointly and your spouse works.

If you are single and have multiple jobs, or you are married and file jointly and both work, you will normally have a Form W-4 for each job. For Form W-4 of the highest paying job, fill out steps 2 to 4(b). Skip those steps on Form W-4s for all other jobs.

If you are married and filing jointly, and you each have one job that pays about the same amount, check box 2(c). Both you and your spouse will need to do that on each of your Form W-4.

If you do not want to show your employer that you have a second job, or that you have income outside of work, on line 4(c), you can enter any extra amount of tax to be withheld from your paycheck. Or do not consider your extra income on Form W-4 and, instead, send estimated quarterly tax payments to the IRS using Form 1040-ES.

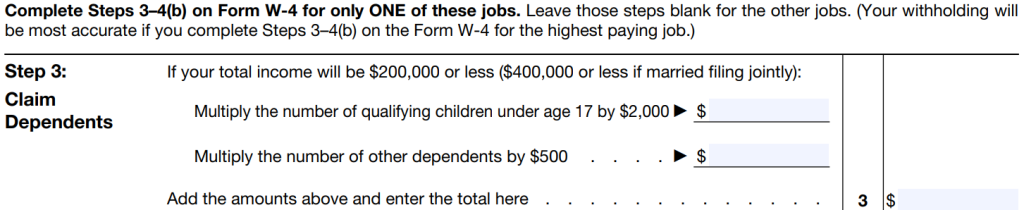

Step 3: If your total income is less than $200,00 (or $400,000 filing jointly), claim your dependents and children under 17. Only complete step 3 for the highest paying job held by you or your spouse (if married and filing jointly). Leave step 3 blank for all other jobs.

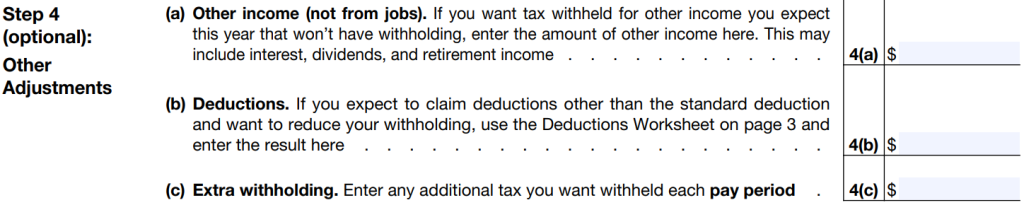

Step 4: Make other adjustments to account for income that does not come from jobs, any other extra withholding, or if you do not plan to take the standard deduction (not common). If you have self-employment income (like a side job), you can have extra money taken out of your paycheck to cover those taxes. Just indicate the amount in box 4(c).

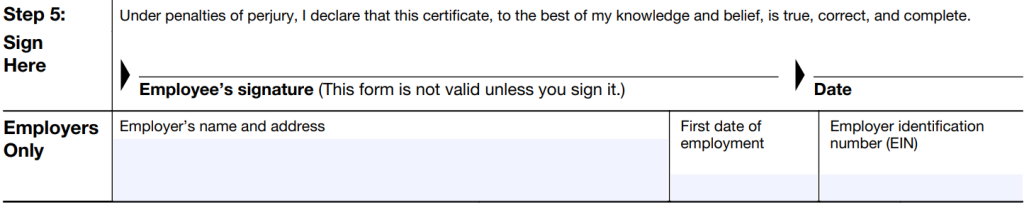

Step 5: Sign, date, and provide to your employer.

Tax Tips

- Use GTM’s nanny tax calculator to estimate your total withholdings and tax responsibility, determine your take-home (or net) pay, and convert a salary to an hourly rate of pay.

- When completing Form W-4, consider using the IRS tax withholding estimator if you:

- Expect to work only part of the year;

- Have dividend or capital gain income, or are subject to additional taxes, such as Additional Medicare Tax

- Have self-employment income; or

- Prefer the most accurate withholding for multiple job situations

Claiming Dependents

To qualify for the child tax credit, your child must be under age 17 as of December 31, must be your dependent who generally lives with you for more than half the year, and must have a Social Security Number. You may be able to claim a credit for other dependents for whom a child tax credit can’t be claimed, such as an older child or a qualifying relative. For additional eligibility requirements for these credits, see Pub. 972, Child Tax Credit and Credit for Other Dependents.

Completing Form W-4 with Multiple Jobs Worksheet

If you choose the option in Step 2(b), complete page three of the Multiple Jobs Worksheet (PDF). This calculates the total extra tax for all jobs. Only complete the worksheet for Form W-4 of the highest paying job.

Questions About Completing Form W-4? GTM Can Help.

For employees paid through GTM Payroll Services, our client support team can help answer questions you may have about Form W-4. Just call us at (800) 929-9213 or email [email protected].

Get your free:

Get your free: